Donald Trump’s return to power could reshape global trade and economic policies. His proposed tariffs for 2025, coupled with inflation and interest rate trends, signal a challenging year for international markets. The International Monetary Fund predicts a “stable but subdued” global growth rate of 3.2%, raising concerns about its implications for everyday lives.

Economic Challenges Under Trump’s Tariff Policies

Inflation and Interest Rates Persist

The US Federal Reserve delivered a third consecutive interest rate cut in December, bringing relief to borrowers. However, Fed Chair Jerome Powell warned against expecting further cuts, emphasizing caution as inflation battles continue. Despite slower price increases, November saw inflation rise in the US, eurozone, and UK to 2.7%, 2.2%, and 2.6%, respectively, underscoring the “last mile” struggle for central banks aiming for 2% inflation targets.

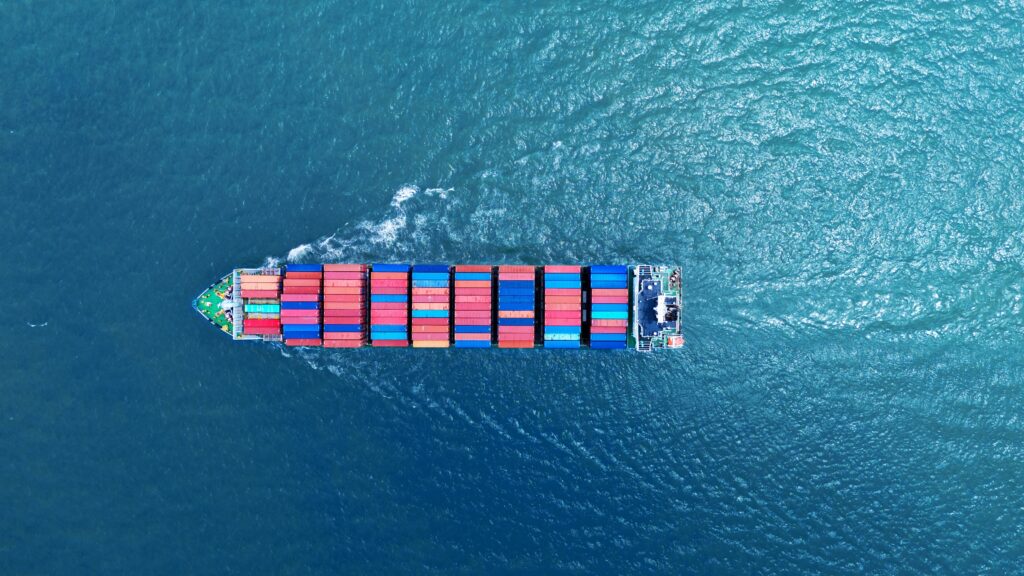

Trade Uncertainty and Global Risks

Trade uncertainty looms large as Trump threatens new tariffs targeting China, Canada, and Mexico. Luis Oganes, head of global macro research at JP Morgan, notes that US isolationist policies may support domestic growth but harm global trade partners. Maurice Obstfeld, former IMF chief economist, warns that disrupting supply chains, particularly in car manufacturing, could increase prices, lower demand, and hinder investment. He cautions that escalating tariffs could push the global economy toward recession.

China and Europe Navigate Mounting Pressures

China’s Economic Balancing Act

China faces domestic hurdles, including weak consumer spending and business investment, compounded by tariff threats. President Xi Jinping acknowledged these challenges but projected optimism about an upward economic trajectory. Despite obstacles, the World Bank revised its 2025 growth forecast for China to 4.5%, citing efforts to strengthen local finances and address property sector issues.

China’s role as a global manufacturing hub remains crucial. Michael Hart, president of the American Chamber of Commerce in China, notes that while companies explore alternatives, replacing China’s manufacturing dominance remains improbable. Electric vehicles, a major export, highlight ongoing trade battles. Recent tariffs imposed by the US, Canada, and the EU are contested by Beijing at the World Trade Organization.

Europe’s Economic Struggles

The eurozone faces sluggish growth amid inflationary pressures and political instability. Germany and France, traditional economic powerhouses, show signs of stagnation. European Central Bank President Christine Lagarde warns that trade restrictions and protectionist measures, including US-imposed tariffs, could harm growth and elevate inflation.

In the UK, higher taxes and wages may also drive prices upward. Wage pressures, stemming from talent scarcity and inflation, are causing businesses to pass costs onto consumers. Sander van ‘t Noordende, CEO of Randstad, highlights wage inflation exceeding 4% in many Western economies, contributing to persistently high prices.

Prospects for 2025 Under Trump’s Economic Policies

Donald Trump’s economic agenda, featuring tax cuts and deregulation, could boost short-term US growth. However, JP Morgan’s Luis Oganes emphasizes the risks to global markets. He expects continued US economic dominance at the expense of other nations. While some hope exists for inflation and interest rates to ease, much depends on the policies implemented by the US government in the coming months.

The global economy awaits the unfolding of Trump’s plans, which could shape trade, inflation, and growth for years to come.